Donate

Support for CIPU is provided by donations from businesses, creators, organizations and individuals who care about the future of innovation and creative expression.

CIPU is a tax-exempt non-profit corporation or 501(c)(3) under federal law and is registered with the New York State Charities Bureau.

Donations are tax deductible to the extent of the law and support CIPU activities, research and content, and help to provide services, including outreach to students, educators and creators.

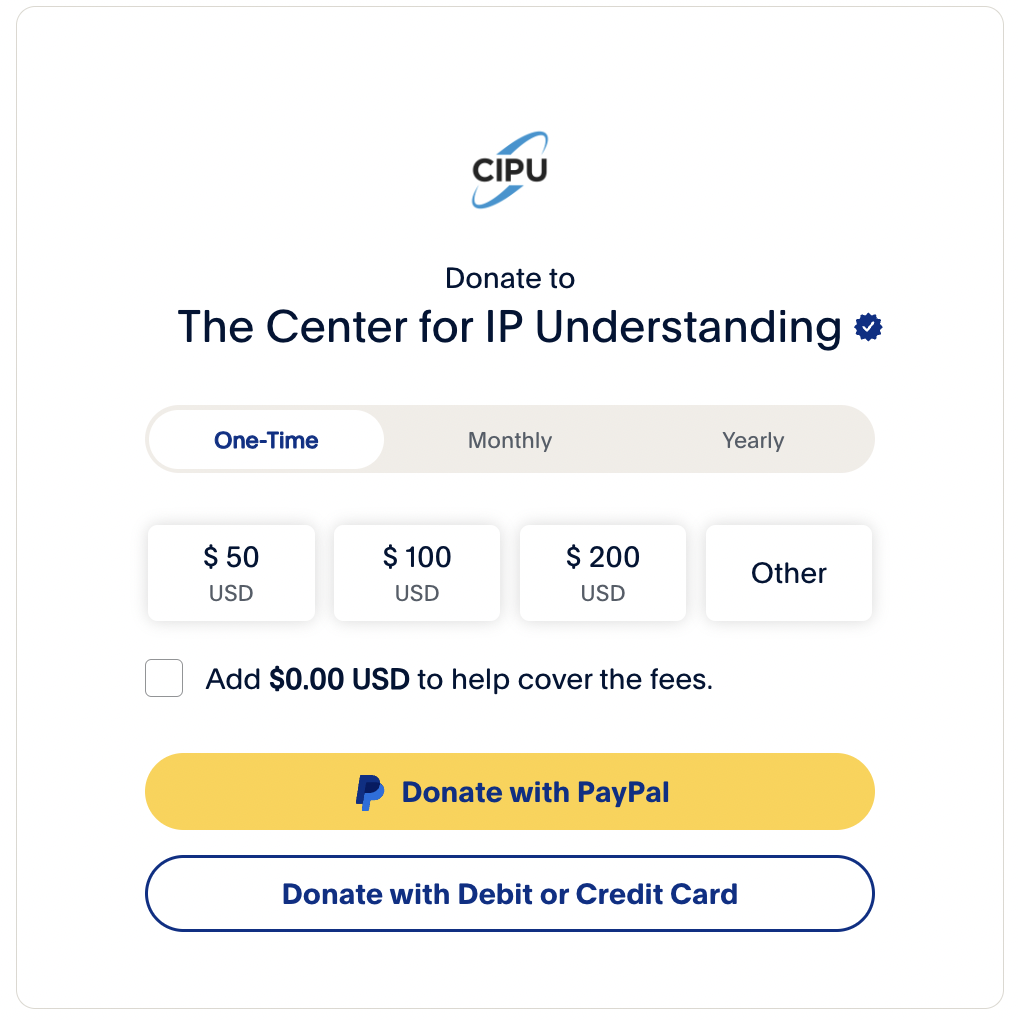

PayPal®

You can donate through CIPU’s official PayPal link here.

To donate by check or wire, to provide a gift of appreciated stock, or if you have questions, please contact please contact CIPU at contributions@understandingip.org.

Your gift can be directed toward CIPU’s general mission or to fund a specific event, research project, activity or speaker.

________________

Tax Deductible

Please remember CIPU in your estate plan.

CIPU accepts gifts of appreciated stock, mutual funds or from donor-advised funds, as well as mandatory IRA or other distributions. These gifts can avoid taxes while having an immediate impact IP literacy.

For further information, including instructions on how to make a gift of stock, IRA transfer or planned gift, please contact us.

______________

Donors’ Corner:

You can donate appreciated assets directly to CIPU

If you have stock, real estate or other assets that have increased in value over the years you can gift them directly to a qualified charity like CIPU, in most cases avoiding capital gains taxes.

Gifting appreciated assets to CIPU also avoids the inconvenience of having to sell them, as well as avoids having to pay tax on the gain.

If you donate a portion of your IRA assets to CIPU you may avoid having to pay tax on retirement income

If you are 70½ or older and have an IRA or inherited IRA, you may contribute up to $100,000 directly from your IRA to a 501(c)(3) qualified charity like CIPU without having to include the distribution as income.

The distribution may be counted as your annual required minimum IRA distribution. A qualified charitable distribution (QCD) can be contributed to one or more charities within the annual limit. A QCD is not subject to New York State income tax either.

*You should confirm your particular tax treatment with your tax professional.